North East councils are wrestling with the problem of how to balance their books and are being forced to make agonising decisions on who they will have to let down next.

These tough calls are being forced on them, and other councils up and down the country, by a system which sees the Government control more than 90% of all tax revenue generated in the UK, a level of centralised control you won’t see anywhere else in Europe.

All too often people will blame ‘the council’ for a multitude of things — when the reality is that the blame lies elsewhere.

So today the challenge to Prime Minister Rishi Sunak — and Keir Starmer, the man who wants his keys to No.10 — is to tell us what, if anything, they will do to end the ‘begging bowl’ approach to funding and come up with a fair and equitable system that will allow local governments to govern.

Writing in The QT today, Prof Bob Hudson said: “While we are focussing on the novelty of regional mayors, the destruction of a layer of local government that has served us well for almost 200 years gathers pace.

“The loss of our civic infrastructure is now impossible to ignore: libraries, museums, leisure facilities, playing fields, public toilets, community centres, parks, youth services and so much more. The civic glue that helped to give us a sense of community, belonging and pride are vanishing, with no obvious way back.”

Local government is often relegated to Cinderella status, despite enduring for hundreds of years and remaining the central provider of local public services

Kevin Muldoon-Smith

Kevin Muldoon-Smith, associate professor in strategic public sector finance and urban adaptation at Northumbria University, said the local government finance system permanently struggles to exist on the margins of viability.

He said: “There hasn’t been a real relative needs assessment carried out since circa 2013. The result is that the local government finance system is quite literally untethered from need.”

Councils have been slowly strangled by successive governments but in the past 14 years there has been a real-terms cut of 40% in their central government grant — with very little change to their statutory obligations, particularly in the provision of social care.

Things are coming to a head. In the past few months, several councils have issued Section 114 notices, which means they are effectively bankrupt because they are unable to balance their budgets.

Last week a threatened rebellion of around 40 Tory MPs saw Prime Minister Rishi Sunak agree what he described as an exceptional provision of £600m to English councils, but the short-term fix is indicative of the issue councils face when setting budgets.

Kevin said: “The bigger problem, and I think the more interesting story, is that the rest of the local government finance system finds itself in a permanently perilous state. Just about getting by every year, but only after impossible decisions are made re what not to fund.”

Yesterday (Feb 13) Newcastle City Council announced that their budget for the coming year will no longer include cuts to its homeless services — another example of the juggling and angst-ridden discussions taking place behind closed civic doors.

Discussions forced on them by a funding system that is out of date and no longer fit for purpose, where local authorities end up in a beauty parade bidding against each other for pots of money for specific projects.

Devolution has come to the North East and it is most welcome.

Tees Valley will, in all probability, like what it has got from devolved powers and responsibilities so far, and there is widespread satisfaction in the north of the region with the devolution settlement that has been negotiated with the Government for the new combined mayoral authority.

But this government — or the next — needs to get to grips with a funding crisis that affects all of us in one way or another.

Kevin said: “Not taking action basically withers local places, and the institutions built to support them. We basically push local government towards the margins of viability and indeed over it.

“We will only see more Section 114 notices but, also, a more hidden world of local authorities making impossible decisions each year to survive — rather than delivering even a minimum standard of public services.”

Many experts are predicting further insolvencies this year. A fifth of local authority leaders are worried about making it through 2023-24 and over half don’t know if they’ll be able to fund statutory services through to the end of 2024-25.

Middlesbrough has already requested exceptional special assistance from the Government to balance their books, in the form of special permission to borrow money or sell assets to pay for day to day running costs, a fiscal fudge that would be strictly against financial regulations in any other circumstances.

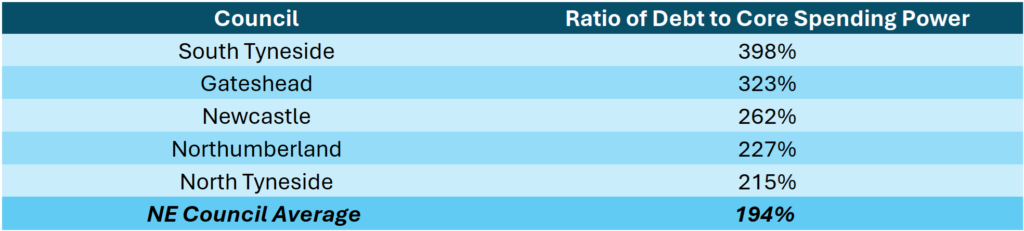

Ratings agency Moodys suggested in September that some councils may have over-borrowed to fund speculative investments, putting themselves at financial risk if the returns aren’t sufficient to cover the repayment costs. They produced a list of the 20 councils with the highest ratio of debt to spending power, and two of the top five (Woking and Thurrock) have already served Section 114 notices. None of the North East councils made the list.

Of the North East councils, South Tyneside has the highest ratio. The top five are:

In South Tyneside the council debt is equivalent £9,000-plus per household, more than double the North East average of £4,182 per dwelling.

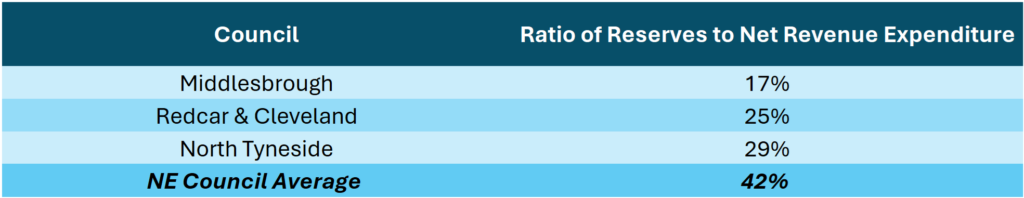

With councils struggling to balance the books, reserves are being used to plug the gaps more than ever before. Consultants Grant Thornton LLP suggest that the ratio of a council’s reserves to its core spending power is another key indicator in determining how likely a council is to face imminent insolvency. They predict 40% of councils could hold reserves of less than 5% of their net revenue expenditure within the next five years, placing them on the precipice of insolvency.

The North East Councils with the lowest ratio are:

All 12 North East councils saw a drop in the levels of reserves held as a proportion of budget between March 2022 and March 2023, with an average drop of 10%. Darlington saw the biggest drop from 92% to 64%, equivalent to a reduction of more than £20m.

The figures may even be worse than we know. Of the 12 North East authorities, only County Durham has had its 2022-23 Statement of Accounts successfully audited. All of the others are still in draft. These delays are mirrored around the country, a situation which would have been unthinkable before Eric Pickles scrapped the Audit Commission in 2015 in David Cameron’s bonfire of the quangos.

Kevin said: “The continual restructuring and patchwork nature of sub-national governance gets lots of exposure as the politics of the day changes. However, local government is often relegated to Cinderella status, despite enduring for hundreds of years and remaining the central provider of local public services.”

See Bob Hudson’s Civilised Society column ‘Town Halls head for political graveyard’

Since 2016, more than £2.3m has been awarded in grants by the Newcastle Building Society Community Fund at the Community Foundation Tyne & Wear and Northumberland.